Do Presidents Impact the Market?

- Damon C Collins, MBA, AAMS®, CFEI®

- Jun 10, 2024

- 2 min read

Updated: Feb 3, 2025

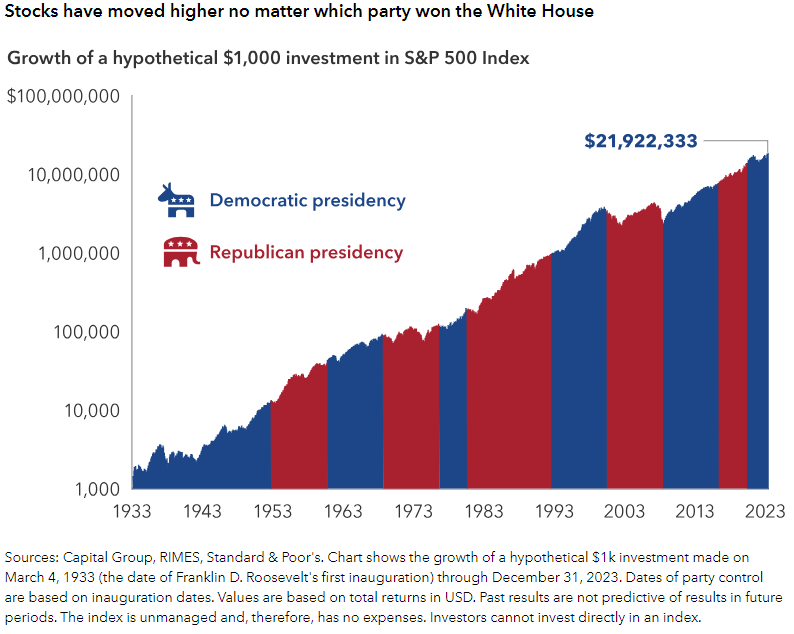

Many believe the market will perform well or poorly depending on who is elected president. Indeed, the stock market's performance is influenced by a complex interplay of factors beyond just presidential policies. The market is not 100% dependable on who the president is.

Let's examine some crucial points about the stock market and its relationship with presidential terms. Here's a detailed breakdown:

President Obama (2009-2017)

Inherited a market deep in recession.

Implemented policies to stimulate economic growth, resulting in significant market recovery.

Dow Jones Performance: 7,949 to 19,732. (First time high) This represents an increase of approximately 149% during President Obama's time as President.

President Trump (2017 -2021)

Continued the market growth, with policies focused on tax cuts and deregulation.

The market saw substantial growth until the pandemic hit in early 2020.

Dow Jones Performance: 19,827 to 30,930.52. This represents an increase of approx—56% during President Trump's first term.

President Biden (2021-present)

Took office during the COVID-19 pandemic recovery phase.

The market has continued to grow, hitting new highs.

Dow Jones Performance: 31,188 to 43,487.83. This represents an increase of approx—39% during President Biden's term.

Factors Influencing Market Performance

Consumer Confidence & Emotions

Investor sentiment plays a significant role. Optimism can drive buying, while fear can drive selling.

Economic Indicators

GDP Growth: Higher GDP growth generally correlates with a stronger market.

Interest Rates: Lower rates often boost the market as borrowing costs are cheaper.

Inflation: Moderate inflation is healthy, but high inflation can harm the market.

Unemployment Rates: Lower unemployment typically signals a healthier economy, boosting market confidence.

Business and Federal Reserve Actions

Business Decisions: Effective management and strategic decisions within companies drive profitability and market valuation.

Federal Reserve Policies: Monetary policies like interest rate adjustments and quantitative easing/stimulus packages can significantly impact the market.

The Takeaways

The stock market has shown resilience and growth under various administrations, highlighting the importance of focusing on long-term trends rather than short-term political changes.

It's essential to base investment decisions on a comprehensive analysis of economic indicators, business fundamentals, and sound financial planning rather than political events alone.

As elections approach, staying focused on your investment goals and maintaining a disciplined approach is wise, as well as avoiding reactionary moves based on political developments.

Understanding these dynamics can help investors make more informed decisions and maintain a steady course toward their financial objectives.

The information herein is intended for educational purposes only and is not exhaustive. Diversification or any strategy that may be discussed does not guarantee against investment losses but is intended to help manage risk and return. If applicable, historical discussions or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax, or financial advice. Please consult a legal, tax, or financial professional for information specific to your situation.

Comments